Lead Gen Costs

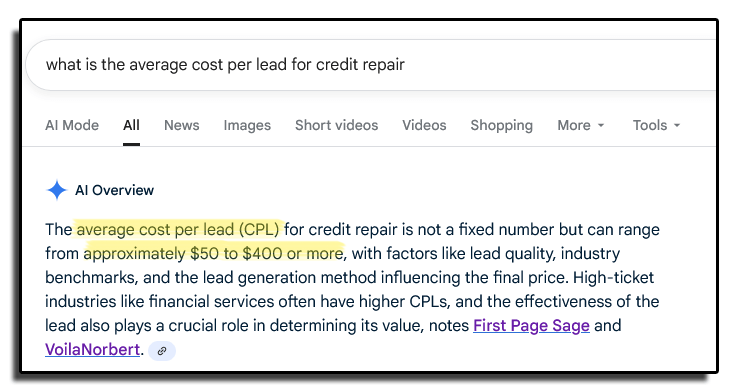

Do a search for yourself and you’ll see that the average cost per lead can vary greatly when it comes to credit repair leads — most agencies are paying anywhere from $50 to $400 per lead. Even those running their own ads or hiring outside “experts” often struggle to keep costs below $30–$60.

We’ve engineered a proven, compliance-driven and automated system that flips the script. Our own ad campaigns consistently deliver high-quality leads for just $2–$10, averaging around $6 per lead year-round, saving agencies thousands every month.