Hands-Free Invoice Management Service

IMS

The Invoice Management Service (IMS) automates every step of your billing operation. From generating invoices to collecting payments and keeping records, IMS ensures that every transaction is logged, compliant, and stress-free.

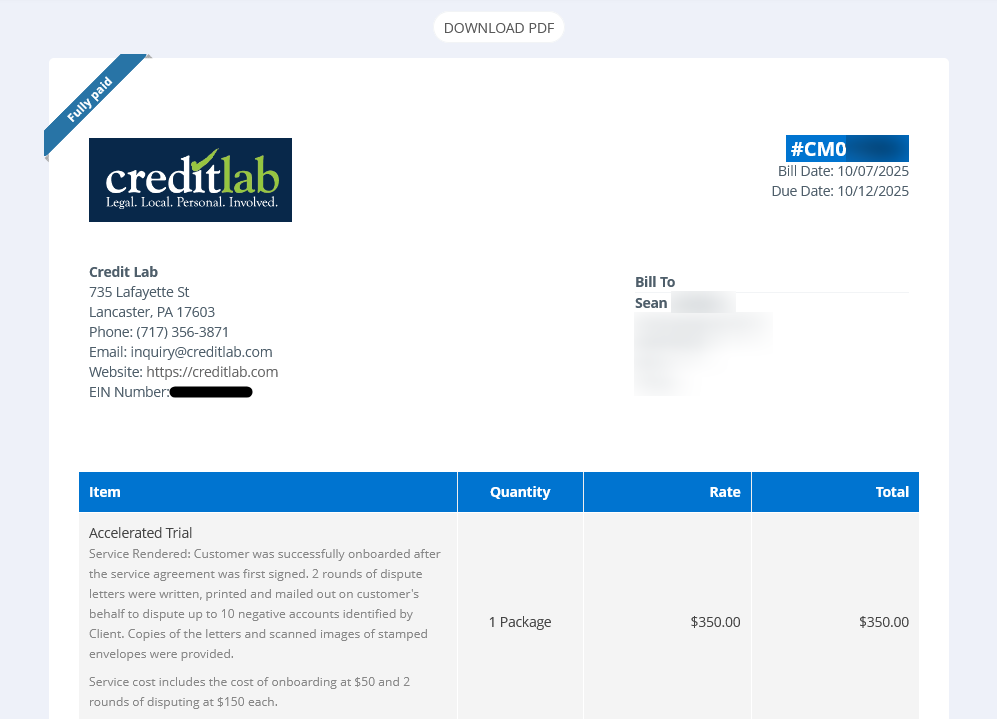

- Maintains your branding and professionalism

- Smooth transition from service delivery to getting paid

- Automated recurring invoices & reminders

- Failed payment recovery sequences

- Live reporting dashboard

- No merchant processing hoops to jump through

- Direct ACH or echeck payout available