Unfair Advantage

For Agencies Ready to Scale Without the Stress

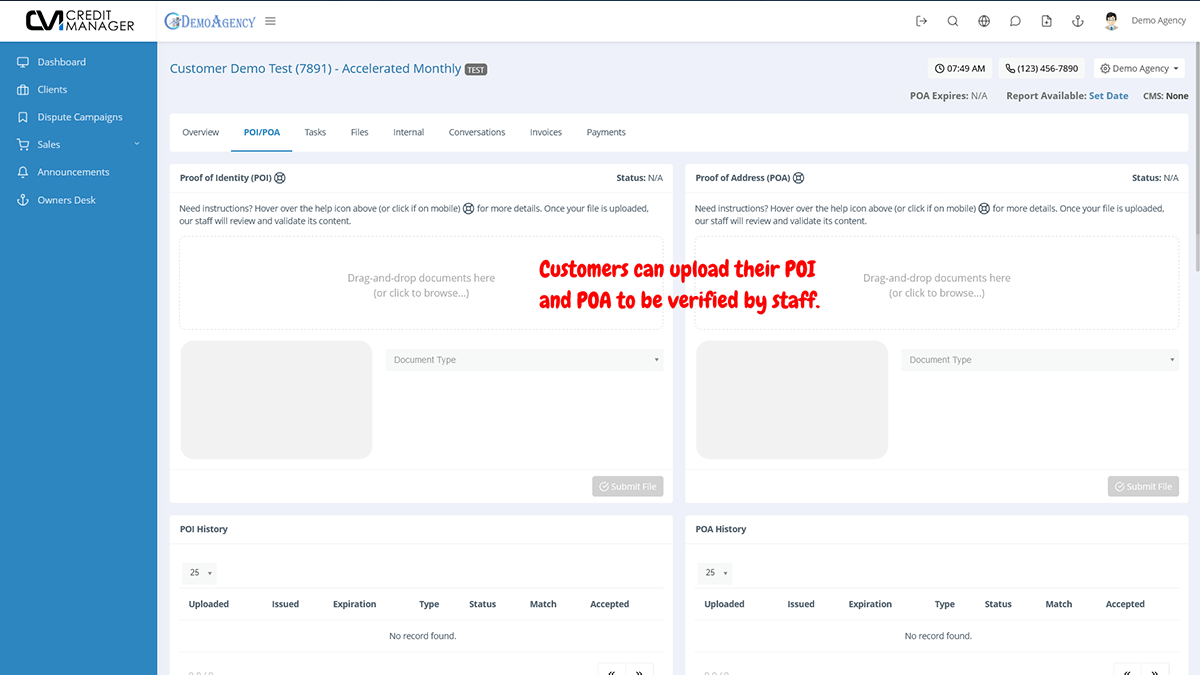

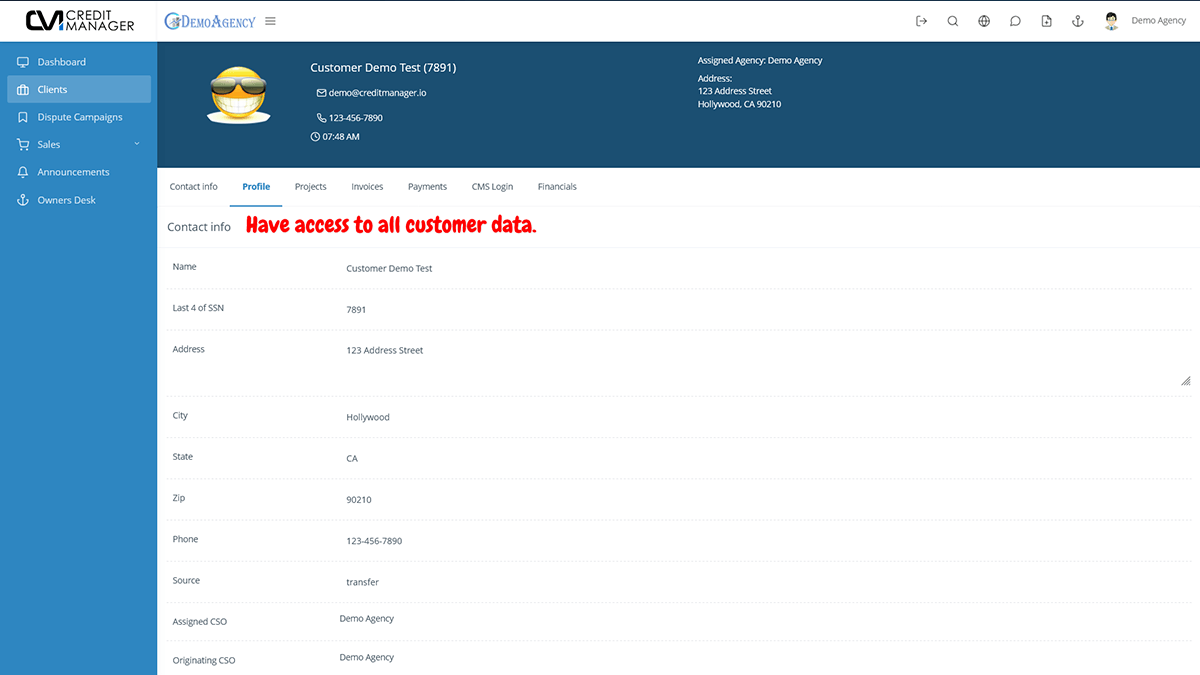

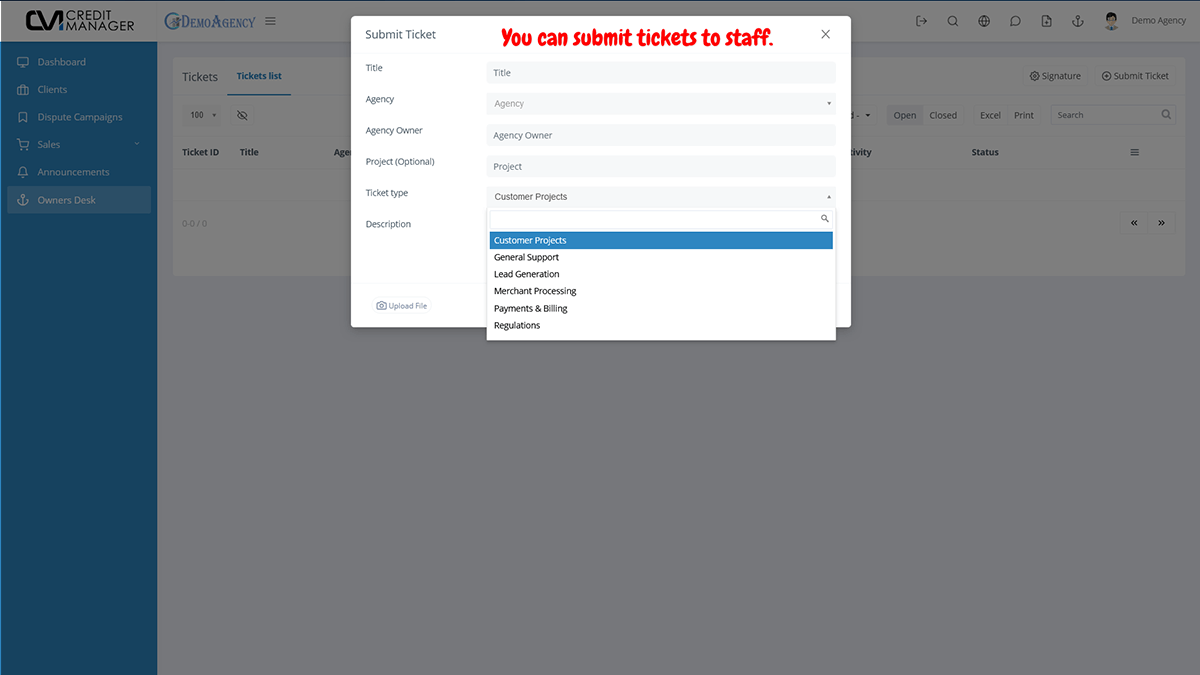

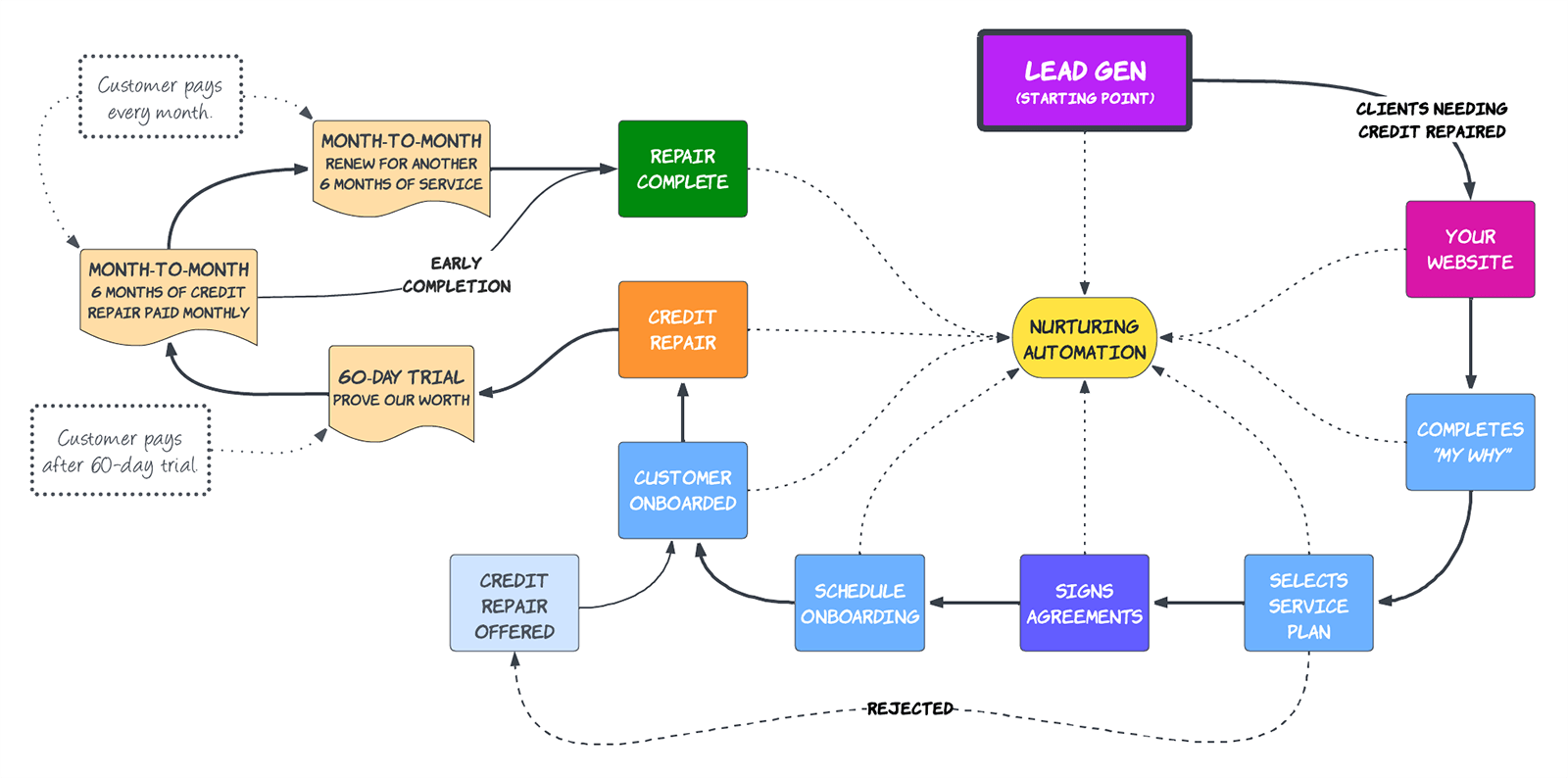

Running a credit repair business on your own can feel overwhelming. From compliance and dispute handling to billing, staff, and customer support — the work adds up fast, and growth often stalls.

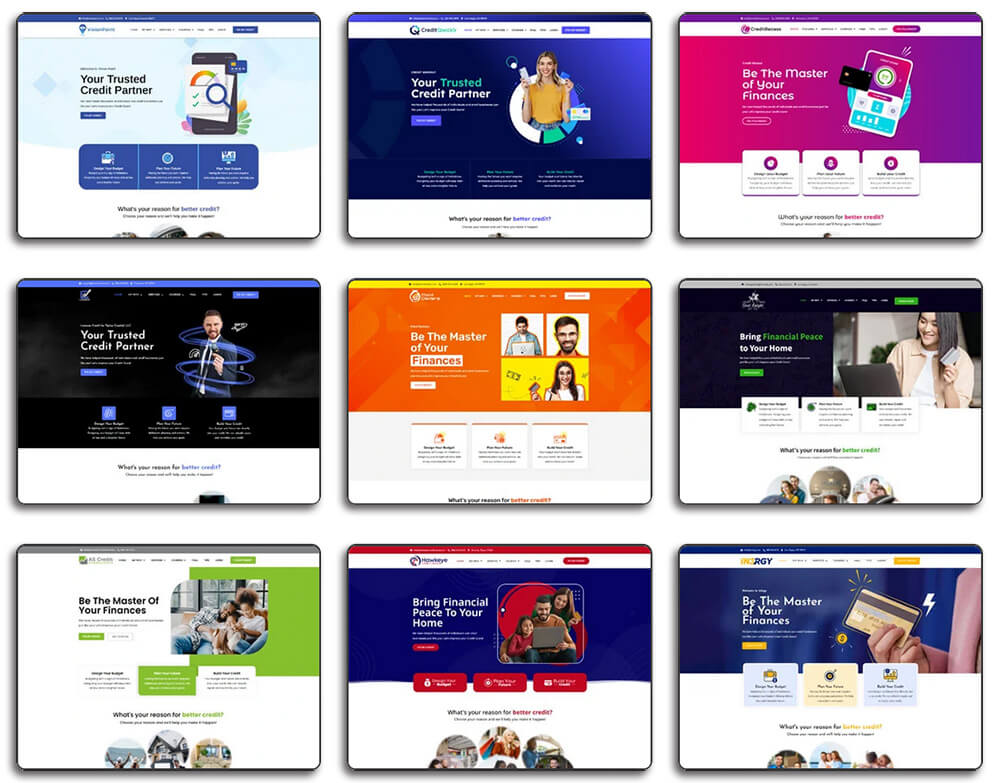

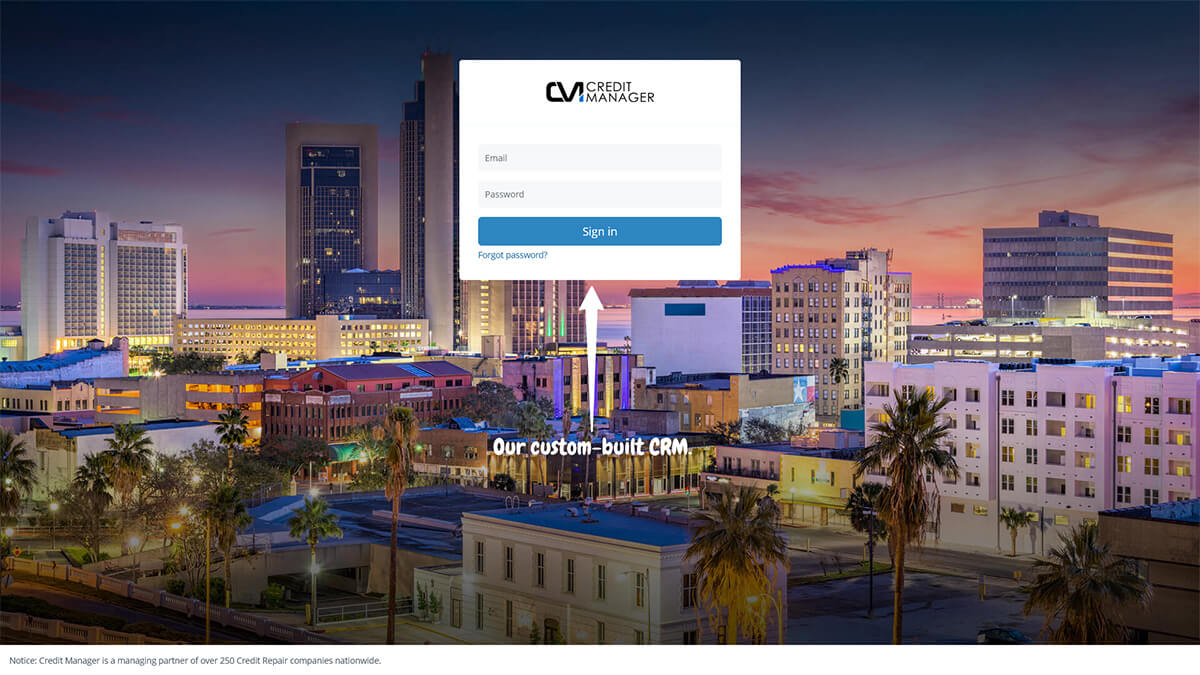

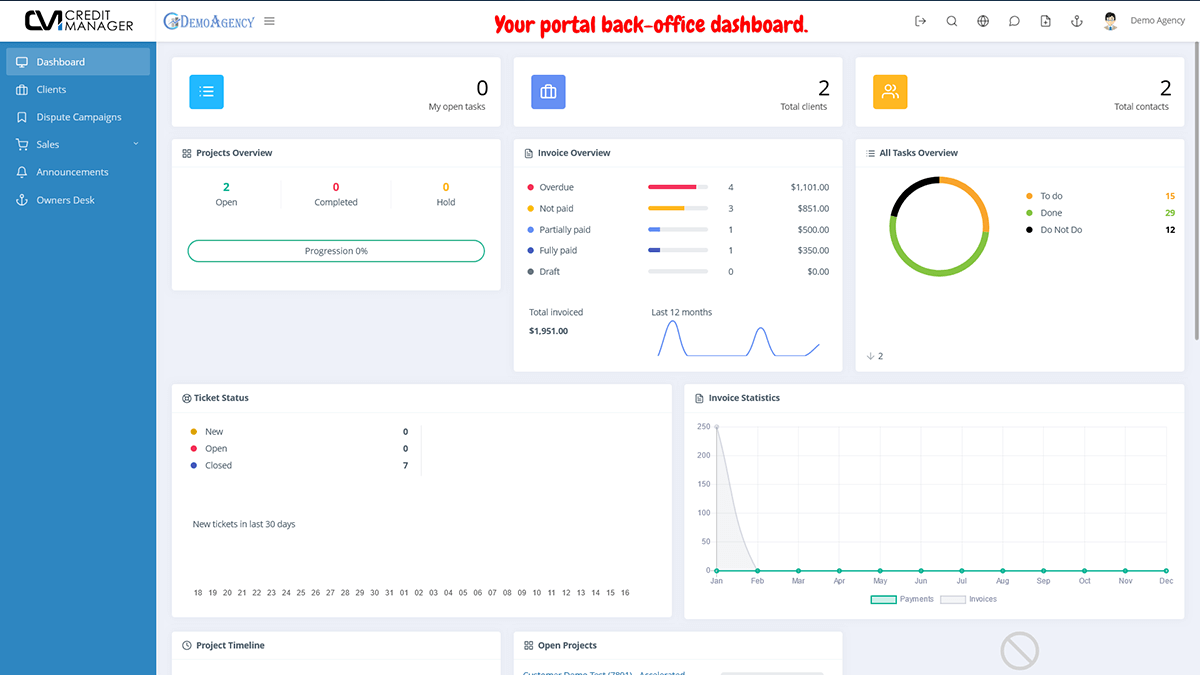

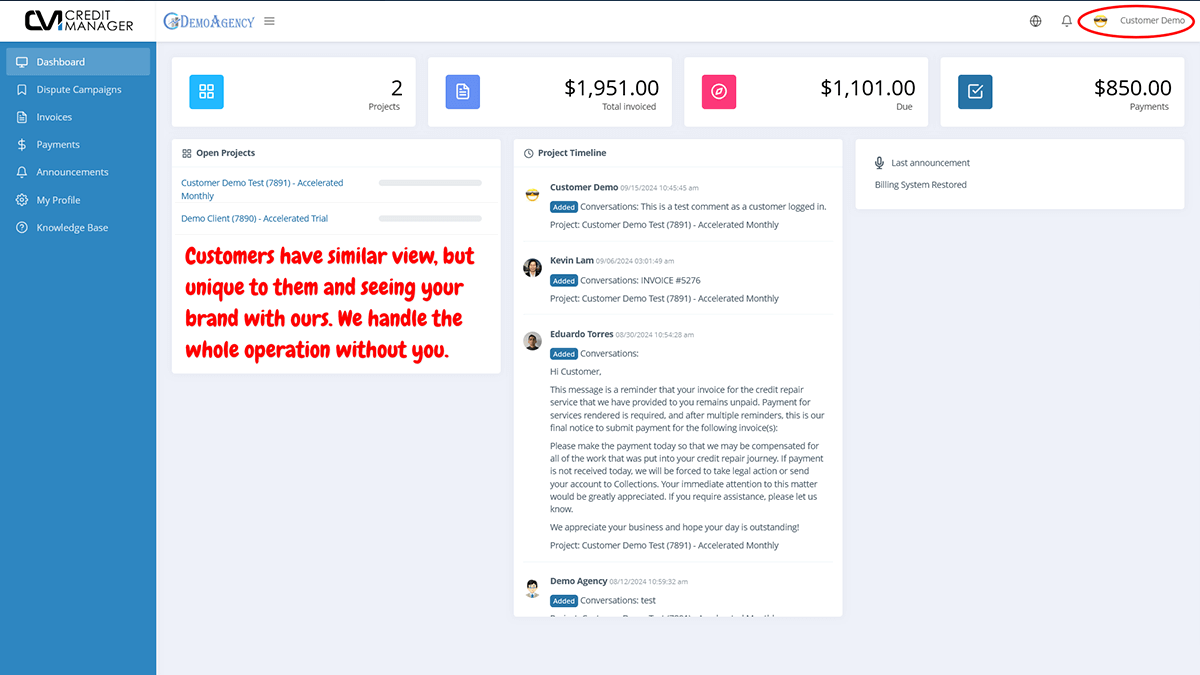

That’s why we created Agency Advantage. It’s a complete, done-for-you infrastructure that removes the bottlenecks holding most credit repair agencies back. Whether you’re just starting out or you already have clients but feel stuck, our system gives you the leverage to grow with confidence, clarity, and compliance.

01

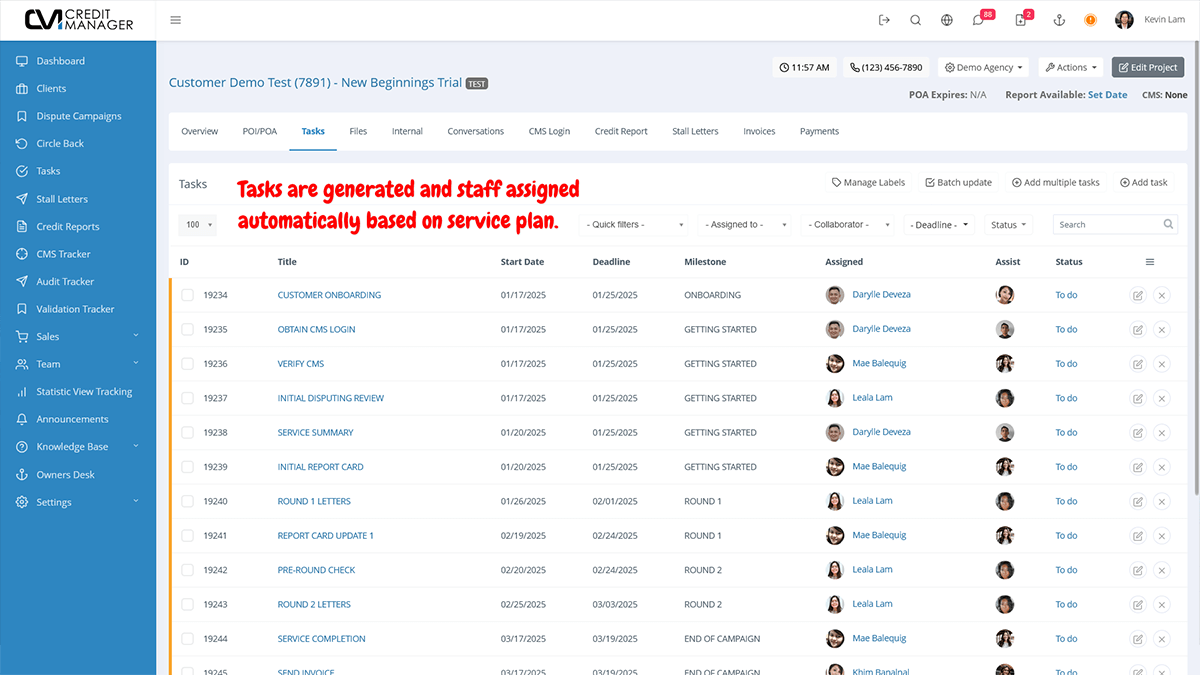

Unleash An Army Without The Overhead

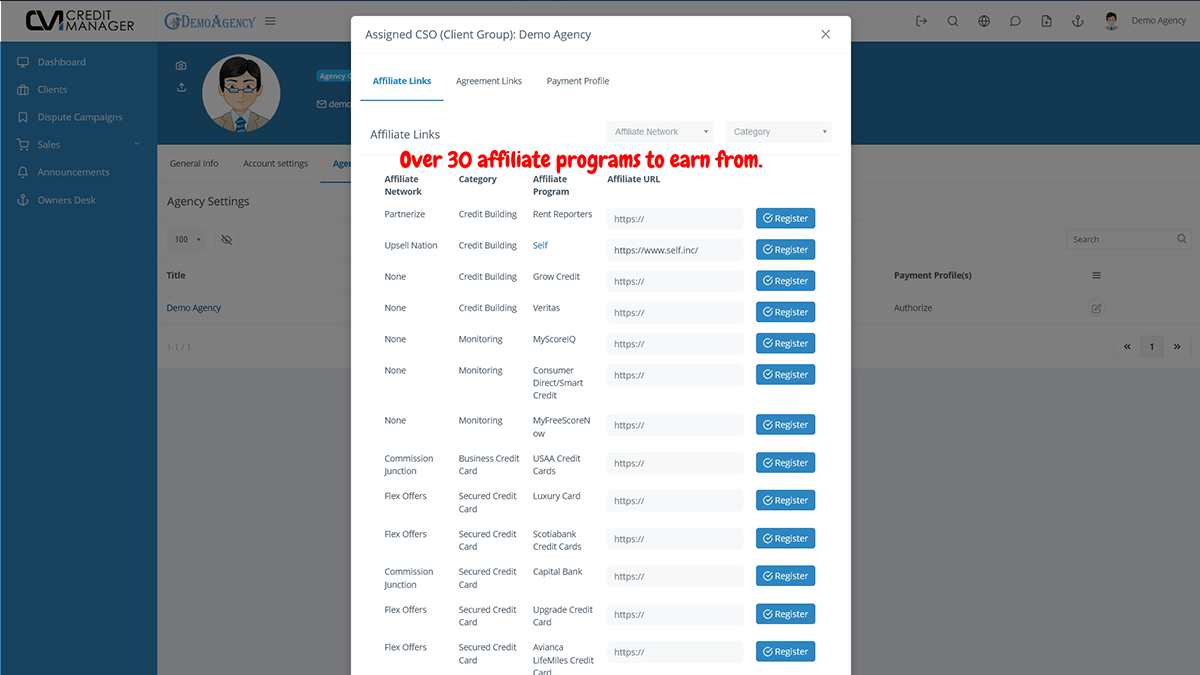

Get the power of a full staff without payroll headaches. Our team, systems, and processes become your back office—so you can scale like a big agency without big expenses.

01

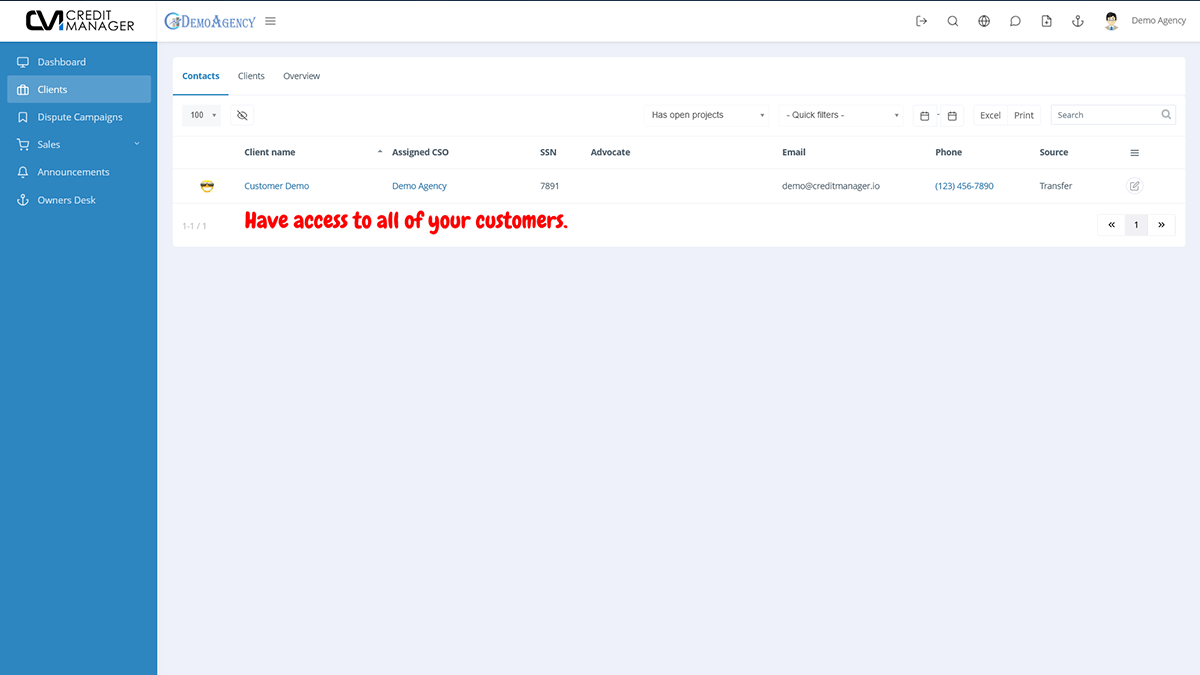

Grow Your Business Without Limits

Break free from caps, bottlenecks, and burnout. With our platform managing the hard work behind the scenes, you’re free to expand your agency as far as you want to take it.